Merchant Processing Agreement (MPA) Guide

Sections of the MPA

(1-3) General and Business Info

(8) Banking Account Information

(9 con't) American Express

(11a) Hardware

(13) Signatures

(4-5) Owner and Partner Info

(9) Service Acceptance

(9 con't) Auth and Misc. Fees

(11b) Card Not Present

Confirmation Page

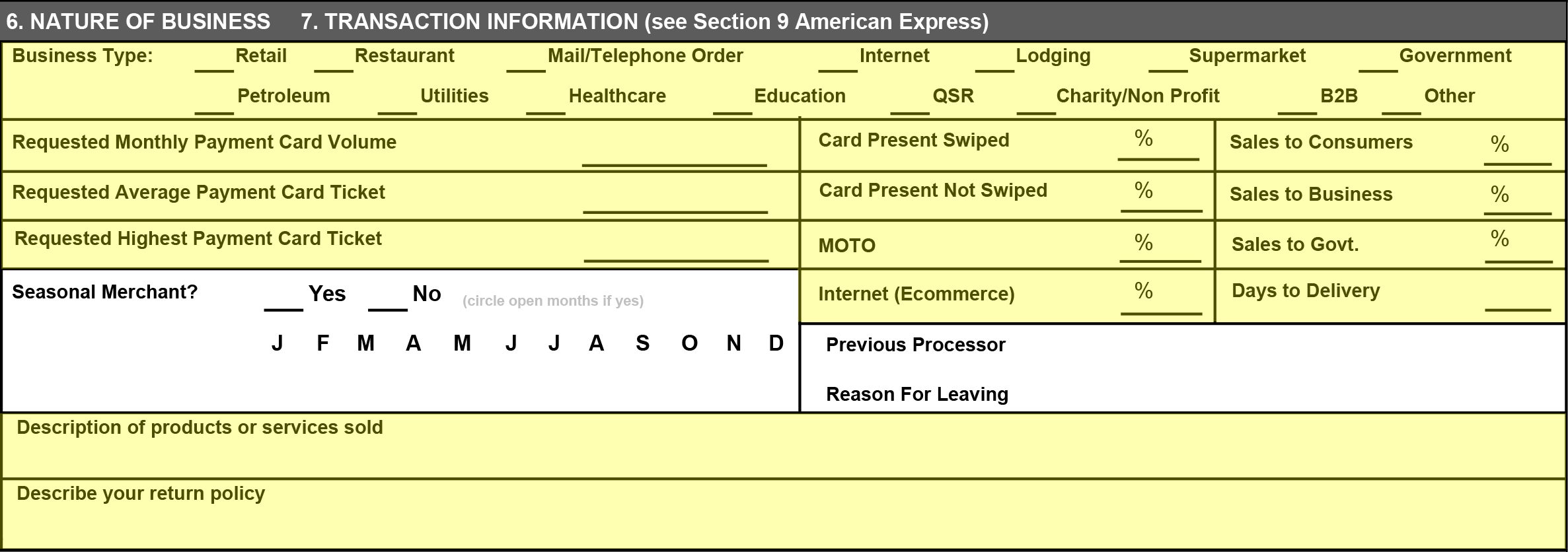

(6-7) Nature of Business

(9 con't) Discount Fees

(10) Other Card Types

(12a-12b) Site Inspection

(1-3) General and Business Information

Client's Corporate/Legal Name and Tax Filing Name- It is imperative that these field match the legal name that the IRS has on file. Failure to match these names may result in a Invalid TIN ID and the IRS holding merchant funds.

Send Monthly Statements to- By default, Priority Payments does NOT send monthly statements. Instead, the merchant can setup a free online account at mxmerchant.com to view reports and monthly statements. To request physical monthly statements to be sent to your merchants, please contact support@priorityis.com.

(4-5) Owner and Partner Info

As of May 11, 2018, all owners/partners with ownership greater than 25% will need to be listed on the application in order to comply with the Beneficial Owner Final Rule (press release). To list more than two owners, please fill out the Merchant Beneficial Ownership and Management Form and include it with your application.

(6-7) Nature of Business

Business Type- This field can determine what information is needed in order to submit the application (i.e.- Choosing "Mail/Telephone Order" will require more information in section 11b)

An accurate estimate is suggested for the following fields as this will prevent red flags for the loss prevention department.

Requested Monthly Payment Volume- Provide an estimate of how much credit card volume the merchant will do on a month-to-month basis. For existing merchants, this figure can be pulled from previous statements.

Requested Average Payment Card Ticket- Provide an estimate of the average ticket amount for credit card transactions.

Request Highest Payment Card Type- Provide the occasional large sale that the merchant might run (i.e.- catering jobs for restaurants).

Card Present Swiped- What percentage of the merchant transactions are swiped/dipped in the merchant's credit card machine?

Card Present Not Swiped- What percentage of merchant transactions are manually keyed customer/card present?

MOTO- What percentage of merchant transactions are taken over the phone?

Internet (Ecommerce)- What percentage of merchant transactions are taken online?

Days to Delivery- What is the time period from the time the customer is charged for the item to the time the item is delivered (i.e.- Days to Deliver for a restaurant is "0")

(8) Banking Account Info

First Data only allows one bank account to be used for deposit and withdrawal (for fees).

Tsys allows you to enter two bank accounts, one for deposit and a separate one for withdrawal.

AHC Method- This decides how the merchant will receive their batch deposits. "Combined" includes one batch for all terminals/separate batches. "Individual" will have a separate deposit for all batches for that day.

(9) Service Acceptance

Select VI/MC/Discover Network Discount Plan- Select the payment plan the merchant plans on using for paying fees

Tiered Basic- Also known as bundled pricing, tiered pricing is a model that charges fees based on the transaction type by placing each transaction into a "bucket". These buckets are:

- Qualified (card present and swiped/dipped)

- Mid-qualified

- For Retail- Low-level swiped/dipped rewards cards and manually keyed transactions with the customer's billing address.

- For e-Commerce and Card Not Present Businesses- Transactions involving a consumer's reward card

- Non-qualified

- For Retail- Commercial cards, upper-level rewards cards, and manually keyed transactions without address verification

Risk Level for the ISO- Low to Medium

During the quoting process, it is important to understand the transaction types the merchant generally runs so you can provide and accurate quote. This will avoid any surprises on their monthly statements.

Flat Rate- Flat Rate Percentage Pricing is one, single rate for ALL transaction types listed above and no additional fees listed in the Per Item field or the Authorization fields in the "Auth and Miscellaneous Fees" section. The largest benefit for the merchant is that statements are easy to reconcile at the end of the month.

Risk Level for the ISO- Medium to High

While many merchants like the idea of Flat Rate Processing, it is important to fully understand their transaction types and average ticket amount before providing a quote. For example, misquoting a merchant who runs a typically high amount of manually keyed transactions could result in a True Effective Rate below interchange. Also, as interchange rates increase it will need to be determined if the ISO will absorb the loss or is the merchant's rate will increase to offset the higher interchange fees.

Pass Through I/C- Also, known as Interchange Plus, Passthrough Pricing charges merchants the industry-wide interchange fees plus a small fixed percentage markup, usually referred to in basis points.

Risk Level for the ISO- Low

Passthrough is the safest plan out of all the options for the merchant and the ISO. It is important for merchants to remember that as interchange levels change, so will their rates.

Discount Payment Method- Determines how often the merchant is billed merchant processing fees.

Daily- Pulls fees out every day

Monthly- Pulls fees out once a month (usually around the 2nd or 3rd of the month) for the previous month's processing.

Assessments- Fees charged by Visa and Mastercard as a condition of membership.

Included- Assessments will be included in the processing fees (typical for Tiered and Flat Rate Pricing) and the ISO absorbs the cost.

Billed Separately- Merchant will see the Assessment Fees as a different line item on their statement (required for Pass Through Pricing)

Brand Fees- Also known as Card Association Fees, these are fees paid back to the bank associations that issues to the card to the cardholder.

Included- Assessments will be included in the processing fees (typical for Tiered and Flat Rate Pricing) and the ISO absorbs the cost.

Billed Separately- Merchant will see the Assessment Fees as a different line item on their statement (required for Pass Through Pricing)

Discount Fees

Disc. (Discount) Fee- The Disc. Fee is the rate charged to the merchant for bankcard (Visa/MC/Discover) transactions.

Tiered Basic- Input the individual rates for each "bucket" into lines 1-8 in the MasterCard, Visa, and Discover Network columns.

Flat Rate- Input the flat rate percentage into lines 1-8 in the MasterCard, Visa, and Discover Network columns. All percentages should be the same.

Pass Through I/C- Input the percentage ABOVE interchange into lines 1-8 in the MasterCard, Visa, and Discover Network columns.

Per Item- Per Item Fee is a dollar amount charged for each SETTLED bankcard transaction. It is important to note that this is different from Authorization Fees (below). An amount entered into the Per Item Fee and in the Authorization Fee will result in the merchant being charged the SUM of the two fees on all settled transactions.

American Express

American Express OptBlue℠ is the latest pricing standard designed to compete with bankcard pricing and is a very popular pricing structure for merchants who accept American Express. Merchants also receive the added benefit or having all credit card types (Amex, Visa, MC,Disc) deposited on the same day and all fees combined on one monthly statement.

Disc. (Discount) Fee- The Disc. Fee is the rate charged to the merchant for Amex transactions.

Tiered Basic- Input the individual rates for each "bucket" into lines 1-4 of the Disc. Fee.

Flat Rate- Input the flat rate percentage into lines 1-4 of the Disc. Fee. All percentages should be the same.

Pass Through I/C- Input the percentage ABOVE interchange into lines 1-4 of the Disc. Fee.

Per Item- Per Item Fee is a dollar amount charged for each SETTLED Amex transaction. It is important to note that this is different from Authorization Fees (below). An amount entered into the Per Item Fee and in the Authorization Fee will result in the merchant being charged the SUM of the two fees on all settled transactions

OptBlue℠ Monthly Card Volume- Provide an estimate of how much Amex credit card volume the merchant will do on a month-to-month basis. For existing merchants, this figure can be pulled from previous statements.

OptBlue℠ Average Card Ticket- Provide an estimate of the average ticket amount for Amex transactions.

OptBlue℠ Highest Card Ticket- Provide the occasional large sale that the merchant might run (i.e.- catering jobs for restaurants).

Select OptBLue℠ Discount Plan- See Service Agreement section (above)

American Express Direct is still available (popular for merchants with special/corporate pricing- you will need the CAP #), however they will be subject to the old pricing standards. For existing American Express accounts you will need to provide an SE number that should be obtained by American Express directly or from the merchant's current Amex statements.

Auth and Miscellaneous Fees

Authorization Fees

Visa/MC/Discover Network- A fee charged on all bankcard transactions (All authorizations [approved, declined and voided] and refunds)

Amex/Fleet/Other- A fee charged on all Amex and Fleet Transactions (All authorizations [approved, declined and voided] and refunds)

Pin Debit Authorizations- A fee charged on all Pin Debit (debit cards using a pin number) Transactions (All authorizations [approved, declined and voided] and refunds)

EBT Authorization- A fee charged on all EBT transactions

Electronic AVS- A fee charged on all transactions where Address Verification is captured.

Voice Authorization- A fee charged on all transactions that involve the merchant calling into the banks for a voice authorization.

Voice AVS- A fee charged on all transactions that involve the merchant calling into the banks for a voice authorization and using the Address Verification System.

Monthly Fees

Monthly Minimum- The minimum amount of total fees a merchant incur. If the merchant fees total less than the Monthly Minimum, the fees will be rounded up to the Monthly Minimum.

Wireless Fee- A monthly fee charged for transactions taken over mobile networks.

Pin Debit- A monthly fee charged for Pin Debit usage.

Industry Non-Compliance- A monthly charged to the merchant for being out of PCI compliance.

Industry Compliance- A monthly fee charged for services involving PCI compliance.

Monthly Service Fee- A general monthly fee ISO can use at their discretion.

Miscellaneous Fees

Sales Transaction Fee- A fee charged for all sales, credits, returns, and batch closures.

Return Transaction Fee- A fee charged for all returns.

Batch Fee- A fee charged for each batch.

ACH Reject Fee- A fee charged for each deposit and withdrawal that gets rejected by the merchant's bank (i.e.- lack of funds or bank account closure).

Chargeback Fee- A fee charged for each chargeback initiated.

Retrieval Fee- A fee charged for each retrieval completed.

Annual Fee- A one time annual fee charged to the merchant (some ISO charge an account on file fee once a year).

Annual Fee Bill Month- The month that the Annual Fee will be charged to the merchant.

Other Card Types

Fill out each section that is applicable to the merchant.

Hardware

IMPORTANT NOTE: Filling out the hardware section on the application does NOT order equipment. This section simply submits a request for the file build team.

For Stand Alone Terminal File Build

Application Type- Determines the type of application that will be downloaded to the terminal.

Fraud Check- Terminal requests the last four digits of the card for manually keyed transactions.

AVS + CVV2- Terminal requests zip code and CVV code for manually keyed transactions.

Purchasing Card- Terminal allows transactions for purchasing cards

Server/Clerk #- Terminal prompts for server number before each transaction (helpful when separating tips at the end of the shift)

Invoice/Purchase Order #- Terminal prompts for invoice number during each transaction.

Auto Close- Terminal will auto batch at the time specified.

IP Connection- Will the terminal process over IP? If Yes, a Datawire will be created for First Data Merchants

Type of Equipment- This specifies the equipment used to process credit cards

Terminal- Stand alone credit card machine

Pinpad- A separate pinpad used to run Pin Debit

Printer- A connected bluetooth printer

VAR- A POS system with integrated credit cards.

Product Name- Name and model number of the standalone terminal or the name of the POS/Gateway system.

Card Not Present Information

If Mail/Telephone Order or Internet is selected as a Business Type in section 6, this section will need to be filled out.

Site Inspection

If applicable, sign this section confirming the site and payment application have been validated.

Signatures

Have each listed partner in the Section 4 sign and date the application

Confirmation Page

You must include the confirmation page with every application. The confirmation page can be found here.