Understanding the Differences Between Cash Discounting and Surcharging

A HOT TOPIC: CASH DISCOUNT & SURCHARGE

There is a high probability you have gotten wind of cash discounting’s growing popularity post COVID. With its growth, the rules are becoming more clear as to how merchants can pass processing fees off to cardholders when using credit cards.

However, the concept of cash discounting and how it differs from surcharging may be unfamiliar to some. Perhaps you’re just now learning about what these terms mean and are curious about how they’re implemented or what the repercussions are. The following post touches on everything you need to know.

THE DIFFERENCE BETWEEN CASH DISCOUNT & SURCHARGING

Cash Discounting is when merchants price and promote their goods and services at credit prices and offer a discount at the time of sale for cash payments.

Surcharging is when the merchant charges an additional fee given to anyone who uses a credit card for payments (excluding debit transactions). Simply stated: the price of the item will go up.

Additional differences:

Cash Discount is offered in all 50 states, while Surcharge is not.

Cash Discount does not require registration with card brands. With Surcharge, you must register with card brands in advance.

Cash Discount achieves the same concept as Surcharge, except with a positive twist. Again, it’s a savings versus a fee.

Cash Discount is suitable for credit and debit cards, including pin debit and swiped transactions, while Surcharge is limited to credit cards only.

THE IDEAL MERCHANTS FOR CASH DISCOUNTING AND SURCHARGING PROGRAMS

To determine which program is right for the merchant it is important to understand how they price their goods and services and how they charge their customers.

When to Use Surcharge

If it is feasible for the merchants to list cash and credit card prices for all items, they will be a good candidate for Surcharging. However, doing so could mean a costly and lengthy registrations process with the card brands. What’s more, surcharging is not allowed in all 50 states, and it is illegal to surcharge on debit card transactions.

Ideally, your business should have a customer first mentality, which will naturally impact your decision. Surcharging provides cardholders more options on how they pay. Thinking through how the customer’s experience will be affected and what program your competitors are using are also important. It is important to note that out of all businesses running cash discounting AND surcharging programs, about 5% of all merchants are running a surcharging program.

When to Use Traditional Cash Discounting

If a merchant provides a verbal or written quote to the customer or if their environment allows them to post the cash price AND credit card price of an item, they will be a great candidate for Traditional Cash Discounting. Cash Discounting removes the card brand fees and red tape associated with surcharging.

IMPLEMENTING CASH DISCOUNTING AND SURCHARGE PROGRAMS

Once the type of program is determined, it is important for the processor and merchant to be familiar with the guidelines that are required. Card brands such as Visa, MasterCard, and Discover require merchants to follow a set of rules and regulations and these requirements can change based on which state the merchant processes in.

Rules Every Merchant Must Follow:

Surcharging

Merchants must register their surcharging program with each card brand no less than 30 days prior to implementing the surcharge program.

Visa’s Registration Page

MasterCard Registration Page

Discover Surcharging Notification FormThe fee and the cost of goods/services must be processed as one transaction. This will require compliant credit card terminals to list the charge individually and submit one approval code for the fee and the goods/services.

Similar to number 6, the merchant will need to run a credit card terminal that can decipher debit cards from credit cards by reading the bin numbers and displaying the fees appropriately.

Cash Discounting

The appropriate signage must be placed at the entry and each POS notifying the customer of the Cash Discounting Program

The amount of the Cash Discount must not be greater than 4% and the merchant can NOT profit from the fee.

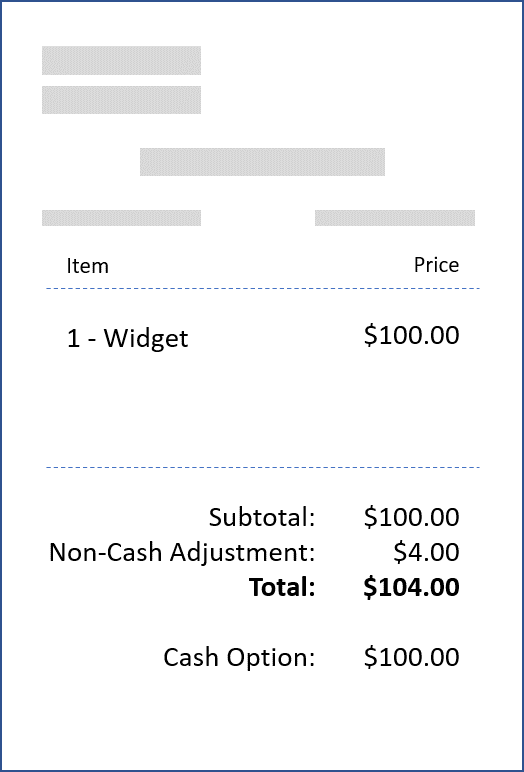

The non-cash adjustment must be shown as a separate line item on either the guest receipt or the credit card slip (sample receipt)

REPERCUSSIONS FOR NOT FOLLOWING THE CARD BRAND RULES

Complaints from cardholders can trigger an investigation from the major card brands. If it is deemed that the merchant was improperly marking up credit card transactions and not following the card brand rules, the merchant can be fined up to $1,000 per occurrence, increasing up to $25,000 per occurrence for repeat offenders. There is also the risk of the merchant losing the ability to process credit cards as well as being placed on a Terminated Merchant File (TMF) list where it would become very difficult for them to process cards in the future.

The steps for running a proper Cash Discount or Surcharge program can seem daunting, but, when done right, the reward can far outweigh the risks. It is important for the merchant to document and stay up-to-date on regulations.

To learn more about cash discounting and how to properly implement it for your merchants, please send us a message below”